Moving from UAE to Estonia (2026 Guide): Visas, Shipping & New Tax Rules

MoveConnector Team

Relocation Expert

Introduction: Moving to the Digital Heart of Europe

Relocating from the UAE to Estonia is a move towards a digitally advanced, nature-rich European lifestyle. As a pioneer in e-governance and a haven for tech startups, Estonia offers a unique blend of medieval history and ultra-modern convenience.

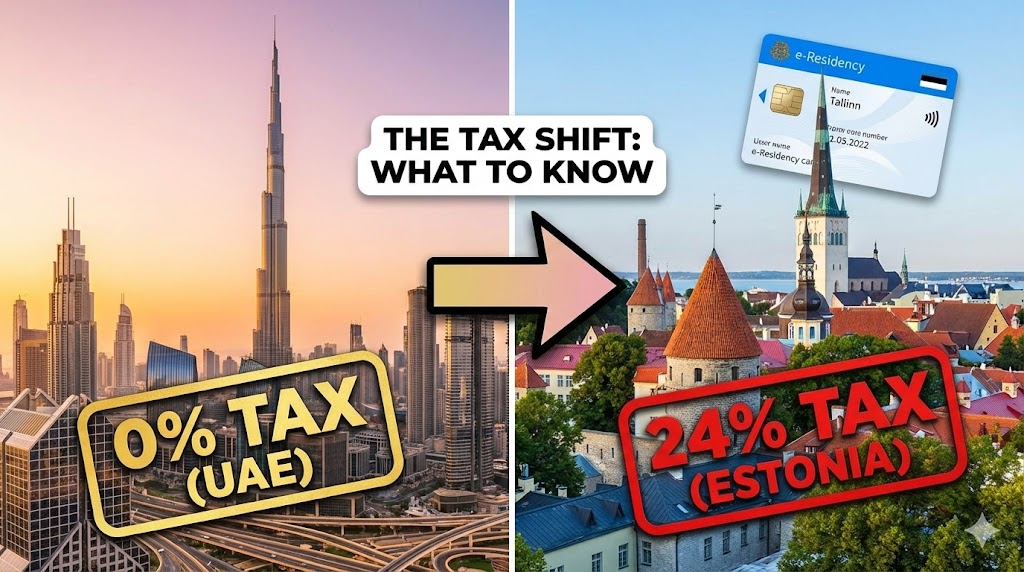

However, moving from a 0% tax jurisdiction (UAE) to Estonia in 2026 comes with financial shocks. With the VAT increasing to 24% and new income tax rules, proper planning is more vital than ever.

This guide provides everything you need to know about shipping your household goods, the €4,500 D-Visa threshold, and settling into one of Europe's most forward-thinking nations.

🚀 Key Takeaways (Quick Summary)

- Visa Threshold: The Digital Nomad Visa (D-Visa) strictly requires a monthly income of €4,500.

- New Tax Reality: In 2026, Estonia’s VAT increased to 24% and personal income tax is a flat 24%.

- Shipping: Sea freight to Tallinn (Muuga Harbour) takes 7–9 weeks door-to-door.

- Car Warning: The new 2025 Motor Vehicle Tax makes importing cars from non-EU countries financially impractical.

1. Visas & Residency: The Digital Nomad Route

Estonia is part of the Schengen Area. For UAE residents (non-EU nationals), you generally cannot just "show up" and stay. Applications are typically submitted at the Estonian Embassy in Abu Dhabi or through authorized visa centers.

The Digital Nomad Visa (D-Visa)

This is the most popular route for UAE freelancers and remote workers.

- Eligibility: You must work for a company registered outside Estonia or be a freelancer with clients mostly outside Estonia.

- Income Requirement: You must prove a gross monthly income of €4,500 for the last 6 months.

- Duration: Valid for 1 year. (Note: It does not inherently lead to permanent residency).

Other Pathways

- Work Residence Permit: Requires a confirmed job offer from an Estonian company.

- Startup Visa: For founders launching a scalable tech business.

💡 Reality Check: e-Residency ≠ Residency. Having an Estonian e-Residency card allows you to run a business online, but it gives you zero rights to live or travel to Estonia. You still need a D-Visa.

🇪🇪 Estonia Reality Check for UAE Expats

Before booking your move, understand the 2026 lifestyle shifts:

- The Tax Shock: Coming from Dubai's 0% income tax, be prepared. Tax residents in Estonia pay a flat 24% Personal Income Tax (up from 20% in previous years). Note: Holding a Digital Nomad Visa does not automatically make you an Estonian tax resident, but extended stays can trigger tax residency depending on days spent and economic ties.

- VAT Hike: As of 2026, VAT on goods and services is 24%. This has increased the cost of groceries, dining, and services.

- Winter Darkness: In December, Tallinn gets only ~6 hours of daylight. SAD (Seasonal Affective Disorder) is real; budget for Vitamin D and winter escapades.

- Digital Society: You will need your digital ID for everything—banking, prescriptions, and even voting. Bureaucracy is fast, but it is 100% digital.

2. Shipping Your Belongings: Sea vs. Air

Your household goods will generally travel from Jebel Ali Port (Dubai) to Muuga Harbour (Tallinn).

Sea Freight Options

- FCL (Full Container Load): Best for 2+ bedroom homes.

- Transit: 40–50 days port-to-port.

- LCL (Shared Container): Best for small apartments or 10–20 boxes.

- Transit: 50–60 days (due to consolidation in European hubs like Hamburg or Rotterdam before trucking to Tallinn).

- Learn more: Shared vs. Full Container Guide

Air Freight

- Best for: Urgent winter clothes and IT equipment.

- Cost: High (approx AED 20/kg).

- Transit: 5–10 days to Tallinn Airport (TLL).

⚠️ Moving Tip: Winter shipping (November–February) carries risks of delays due to ice conditions in the Baltic Sea, though Muuga is largely ice-free.

3. 2026 Moving Costs Breakdown

Shipping to Northern Europe is generally more expensive than Southern Europe due to longer transit distances.

| Shipment Size | Service Type | Estimated Cost (AED) | Timeframe (Door-to-Door) |

|---|---|---|---|

| Small Move (10-15 CBM) | LCL (Shared) | AED 12,000 – 18,000 | 8 – 10 Weeks |

| 2-Bed Home | 20ft Container | AED 22,000 – 28,000 | 7 – 9 Weeks |

| 3-4 Bed Villa | 40ft Container | AED 35,000 – 42,000 | 7 – 9 Weeks |

Note: These estimates exclude insurance and the new higher VAT on local services in Estonia.

4. Customs & Taxes: The "Transfer of Residence"

Despite the high VAT, you can import your household goods duty-free under the Transfer of Residence (isikliku vara sissevedu) rules.

Requirements for Duty-Free Entry:

- 12-Month Rule: You must have lived outside the EU (in UAE) for at least 12 months.

- 6-Month Rule: You must have owned and used the items for at least 6 months. Do not ship brand new electronics in their boxes.

- Timing: You must import goods within 12 months of your residence permit start date.

Required Documents:

- Passport & D-Visa / Residence Permit.

- Signed Lease Agreement in Estonia.

- Comprehensive Packing List (in English or Estonian).

- Customs Declaration Form.

5. The Car Import Trap (2025 Update)

In 2025, Estonia introduced a Motor Vehicle Tax which changed the game for imports.

- Registration Fee: You pay a fee based on CO2 emissions and age upon registration.

- Annual Tax: You pay a yearly tax for ownership.

- Homologation: Gulf-spec cars often fail EU cold-climate specs (heating systems, tires, lights), requiring expensive modifications.

- Verdict: Sell your car in Dubai. The depreciation + shipping + new taxes make importing financially impractical for most expats.

- Guide: How to Export/Sell Your Car in UAE

6. Common Mistakes When Moving to Estonia

- Underestimating Winter Delivery: If you are moving to Old Town Tallinn (Vanalinn), delivery trucks often cannot access narrow, snow-covered streets. You may face "long carry" charges if the movers have to park far away.

- Shipping Without EU Fire Labels: Upholstered furniture often requires EU fire safety compliance labels. While customs are sometimes lenient with used goods, it is a risk factor.

- Language Barriers: Assuming English is accepted for all paperwork can cause delays. While common, some specific forms may need Estonian translation.

- Forgetting Reflectors: It is a legal requirement in Estonia to wear a reflector on your clothes during dark winter months. Pack one in your carry-on!

Frequently Asked Questions (FAQ)

How long does shipping take from UAE to Estonia?

Sea freight from Jebel Ali to Muuga Harbour (Tallinn) typically takes 40–50 days port-to-port. You should budget 7–9 weeks for the complete door-to-door process including customs clearance.

What is the income requirement for the Estonia Digital Nomad Visa in 2026?

For 2026, the monthly income threshold is €4,500 (gross). You must prove this income for the 6 months preceding your application via bank statements.

Is it expensive to move to Estonia?

Shipping a 20ft container (2-bedroom home) costs between AED 22,000 and AED 28,000. While rent in Tallinn is cheaper than Dubai, daily costs are rising due to the 2026 VAT increase to 24%.

Can I bring my car from Dubai to Estonia?

It is not recommended. As of 2025, Estonia introduced a new Motor Vehicle Tax (registration fee + annual tax). Combined with EU homologation costs, it is almost always cheaper to sell your car in the UAE.

Ready for Your Baltic Move?

Don't let the new tax rules catch you off guard. Get quotes from movers who understand the 2026 regulations.

What we provide:

- ✅ Licensed UAE-to-Baltic Movers

- ✅ Door-to-Door Service (Tallinn, Tartu, Pärnu)

- ✅ Customs & D-Visa Guidance